Background information

Background information

Many options exist for the marketing of your wool clip. The price of wool is highly volatile, with this volatility being a major risk for any wool growing business. Understanding the value of your wool before sale can assist in assessing marketing options and the use of price risk management tools. Knowing where current prices sit in relation to historical values can also help reveal the current point in commodity price cycles.

Introduction

Wool producers have many selling options available to them. The options will vary according to the scale of your enterprise, and the characteristics of the wool you produce (micron, market speciality). To secure the true market value of your wool, work with your wool broker or adviser when using any of these selling options. The more commonly used methods include:

- Open-cry ‘progressive’ auction

– The preferred method of sale and ownership transfer for about 85% of wool producers. This system is facilitated and managed by wool brokers, guarantees payment, and allows maximum exposure and competition for wool at sale time, with all major buyers of Australian wool present in the auction rooms.

- Private treaty

– Prices are negotiated privately with buyers at or about the time of shearing. Wool may be sold either tested or untested, however, untested wools will not be paid the same as tested wools.

- Forward sales – A contract is made before shearing to deliver wool to an agreed specification and to an agreed price schedule. Payment is made against the actual test results. Remember that once contracted, your wool must meet specifications.

- Direct to topmaker/exporter – Similar to forward contract, but a spot sale through an exporter for delivery direct to a topmaker. Negotiation of the final price in Australian currency must be managed carefully to eliminate fluctuations in currency exchange rates.

- Internet selling – There are two types of internet selling platforms:

Electronic offer board where wool - is available for sale to buyers 24 hours a day, 7 days a week. A reserve price is ‘posted’ (presented for sale on computer screen) and can be simultaneously seen by all registered buyers. Submission of bids and final sale is facilitated via the offer board, and not directly with the seller. The most significant advantage of an electronic offer board comes in a rising market, when it allows buyers to purchase wool lots outside the scheduled auctions. See the link to Wooltrade.

On-line auction replicates an - open-cry auction system, but is conducted via the internet and can be accessed from anywhere in the world. Transactions are made directly between buyer and seller and in real time. See the link to Elders On-Line Global Wool Auction.

- “Special feature” sales – An open cry progressive auction where the ‘speciality featured wool’ is specially marketed and consolidated, providing critical mass for the buyer of that speciality lot, eg, the Elders organic wool auctions.

- Grower marketing groups – Grower based marketing groups established to sell direct to processors and manufacturers. Grower marketing groups need a structure, training and a sound business case to succeed and be profitable over time.

If immediate sale prospects are poor at the time of shearing and the outlook is for improving price, consider holding wool in store pending a later sale (defer selling). Alternatively, sell part of the clip (split selling) and defer the remainder to a time of lower supply. Work closely with your wool broker or adviser and be aware of storage costs and the time value of money.

Key decisions, critical actions and benchmarks

Key decisions, critical actions and benchmarks

Valuing your wool

You can use the web-based tool, Woolcheque, to independently value your wool clip with the prices sourced from the historical AWEX market reporting system.

Woolcheque can be used for:

- Modeling different clip scenarios and flock management strategies

- Daily and historical valuation of clip details

- Understanding the role that premiums and discounts for staple strength, VM, staple length etc play in achieving profitability

- Appreciating the importance of price risk management.

Woolcheque includes up-to-date market pricing, useful price charts and lot benchmarking. The key operational processes are outlined on the Woolcheque website,

www.woolcheque.com.au

Alternatively, you can use your wool brokers’ appraisals. These appraisals may differ from those provided by Woolcheque. Brokers’ appraisals incorporate a visual inspection of your wool in the sample box, anticipated market movements and the quantity of offerings in the forward weeks to provide an estimate of what your wool will achieve at auction. Woolcheque values your wool based on previous auction results only. It is prudent to use both the Woolcheque valuation and your broker’s appraisal when marketing your wool.

Selling options

Plan your selling system 4–6 months before shearing commences. The final choice will be determined by a number of factors including:

- Short- to medium-term market outlook and projected price trends

- Estimates of the value of your wool using information from broker valuations, forward markets or Woolcheque

- Prices on offer relative to that valuation and expected price trends

- Estimates of selling and possible storage costs

- Your own financial circumstances, including the cost of production

- Potential risks of market volatility and your approach to managing price risks.

It is recommended that you monitor market conditions and review approaches to selling, up to the point of sale.

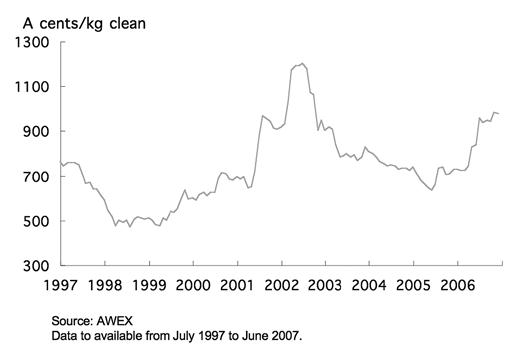

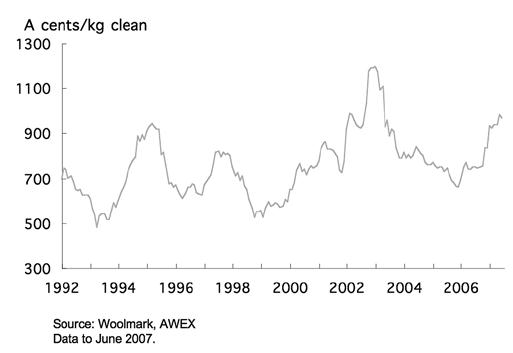

Figure 2.1: Commodity price cycles in key wool markets over 15 years (Source: The Woolmark Company) Western Market Indicator

Figure 2.1: Commodity price cycles in key wool markets over 15 years (Source: The Woolmark Company)Eastern Market Indicator

Managing price volatility

The profitability of your enterprise is determined by a combination of seasonal conditions, your personal management programs, and wool price cycles. Wool prices, like all commodity prices, move in cycles, as shown in figure 2.1 below:

A recent study indicated that wool price volatility is the major source of business risk on woolgrowing farms. Wool price volatility contributed about 80% of the variability of return on equity, while production risk contributed about 20% of the variability. Yet few wool producers have appropriate strategies in place to reduce the risk of low and unprofitable wool prices.

Price risk management programs and products can help protect your profitability from volatile commodity prices and the vagaries of the weather.

Wool brokers and advisers can access a wide variety of price risk management tools around the world to help reduce the uncertainty of future cash flows. It is important to seek professional advice to understand the practicalities and implications when developing strategies to manage price risk. Options include:

- Making use of forward selling or hedging options such as selling wool futures before shearing.

- Accessing price risk management tools through a wool agent or exporter. This eliminates most of the risk of price fluctuation, but production and wool quality risk remains.

- Exploring fixed price wool indicator contracts, wool minimum price facility, and deferred price contracts.

Some on-farm approaches to managing the current market situation and possibility of price volatility at the time of sale include:

- Spreading the risk by offering your clip over more than one scheduled sale

- Setting well researched and realistic reserves to protect against downside risk of price fluctuations and maintain flexibility up to the time of sale.

Holding wool in storage requires an assessment of the likely storage costs and financial impact of a delay in wool sales against the potential for price gains when wool is finally sold.

Read

A Marketing Guide for Wool Growers: a manual that outlines the various methods and operations involved in selling wool. To order, call the AWI Helpline 1800 070 099 (free within Australia). Risk Management for Woolgrowers: explains alternative approaches to risk management. To order, call the AWI Helpline 1800 070 099 (free within Australia).

Factors Affecting the Business Risk of Wool Growing Farms in the High Rainfall Zone of Australia: explains why managing price volatility is important for woolgrowing enterprises: http:// sheepjournal.une.edu.au/sheepjournal/ vol45/iss4/paper4/

View

Elders Online Globalwool Auction: this online auction system gives wool buyers, mills and merchants the opportunity to participate in the Elders Global Auction from anywhere in the world: http://wool. elders.com.au/sellingdetail.asp?RefID=18

Wool Trade: an internet based wool selling and trading system allowing wool producers to offer their clips to all buyers 24 hours/7 days per week: www.wooltrade.com.au

Elders Exchange Desk: provides woolgrowers with the mechanism to sell wool quickly and efficiently outside of the auction system: http://wool.elders.com.au/sellingdetail.asp?RefID=4

Woolcheque: the wool pricing tool for Australian wool producers: www.woolcheque.com.au

Websites for managing wool price risk and market volatility can be found at:

- Elders Risk Management (wool):

http://riskmanagement.elders.com.au/wool.asp

- Landmark Risk Management Online (wool): www.landmark.com.au/bm_wrm.asp

- Australian Wool Network Price Risk Management: http://www.woolnetwork.com.au/aboutus/options.php

- National Australia Bank Agribusiness Price Risk: www.national.com.au/Business_Solutions/

- Australian Securities Exchange (ASX) Wool Futures: www.asx.com.au/investor/futures/wool/index.htm

Elders On-line Client Services: Elders clients can register with Elders Online Client Services to access a range of information including wool test results and sales prices. Visit: http://www4.elders.com.au/default.asp

Landmark Wool Clip Information: available to Landmark clients for any wool sold through Auction or electronic marketing. Visit: https://www.landmark.com.au/woolinfo/formslogin.asp

Landmark Wool Procedures Manual: provides wool producers with the step by step guide on how to access a number of wool marketing alternatives to auction including Fibre Direct and ‘farm to mill’ supply arrangements: www.landmark.com.au/wool.asp

Landmark Precision Wool Marketing Systems: incorporates the complete range of Landmark’s products and services available to wool producers. Visit: https://www.landmark.com.au/ (click on the “Wool” tab on the left hand side of the page)

AWEX up-to-date market reports: receive regular market reports by fax, email, or SMS by subscribing to one of these services from AWEX. Call (02) 9428 6100 for more information, or visit the website: http://www.awex.com.au/scripts/nc.dll?AWEX.852486:STANDARD:1262344700:pc=L2C1

Contact your local wool broker and arrange for a licensed futures adviser to contact you.