Introduction

Introduction

When market prices are low, cattle feeders are sometimes tempted to hold cattle in the feedlot past normally optimum weights and levels of finish. Rather than selling at a loss or for a minimal profit, the operator may predict that the market price will rise during the coming weeks, justifying retaining the cattle past their normal weight and fat level. This strategy may work, or it may just incur larger losses. The following shows some of the animal, feed and economic factors to consider when adjusting marketing strategies.

Operating Margin

Generating the highest possible margins in cattle feeding depends on maximizing the difference between cattle revenue and operating costs for the feedlot animals. The operating margin is not the same as total profit. It does not take into account costs independent of the number of cattle fed. Once a feedlot is in operation, there are many costs such as investment in facilities and land, depreciation on assets and insurance, that have already been incurred and so do not affect the operating margin.

Cattle revenue is the product of the weight of the animal times its selling price (including any discounts). Operating costs are the sum of expenses such as feed, yardage, marketing and interest on cattle. Maximizing the operating margin requires that animals be sold when the difference between the value of an animal and the costs incurred by that animal is at its greatest. While this seems easy enough in principle, it is far more difficult in practice, since many factors come into the equation, including declining feed efficiency as cattle grow heavier and the risk of discounts due to overweight or over-finished animals.

Feedlot Performance, Costs and Market Prices

Cattle performance in a feedlot is determined by the interplay of several factors, including genetic make-up of the animals, current weight of the animals, level of energy (and other nutrients) in the diet, dietary intake, hormonal implant program and environmental conditions. Operating costs include the cost of the feed ingredients and bedding, labour costs and the interest rate applied to the cattle.

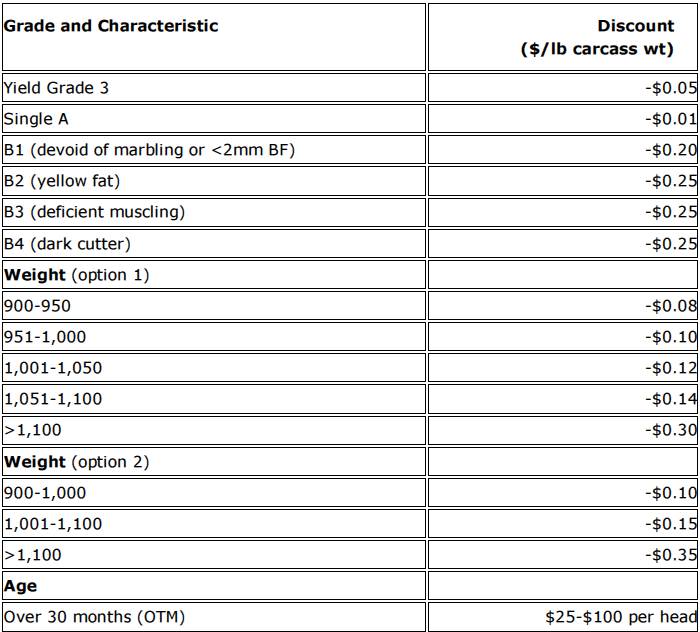

The revenue returned by a given animal is influenced by a combination of its weight, level of finish, estimated retail yield and marbling. The grading system categorizes carcasses into yield grades (retail yield) and quality grades (marbling). Individual carcass value is usually arrived at by using a base bid market price per pound for a specified carcass, with various discounts applied when the specified parameters are not met (Table 1). Typically, the criteria include a carcass weight range, yield grade range and quality grade.

Table 1 shows representative Ontario discounts for carcasses based on weight, yield grade, quality grade and age (youthful or over 30 months of age). Processors set their own optimum ranges for carcass size, yield grade and marbling. Cattle outside these ranges will receive a discounted price to reflect their lower value to the processor. Cattle that fall outside of the ‘A’ grid such as B1s (devoid of marbling or with <2 mm back fat) and B4s (dark cutters) attract significant discounts. In some value chains, there may be premiums offered for certain traits such as AAA or Prime marbling, or smaller carcass sizes. Consult your processors to obtain current price structures.

Table 1. Typical Weight and grade Discounts for Finished Cattle in Ontario